The New Vertical SaaS Playbook

How more open technology standards are transforming the playbook for scaling vertical software.

01 | The old vertical SaaS playbook

Vertical SaaS (vSaaS), software tailored to specific industries, has long been a compelling category in venture.

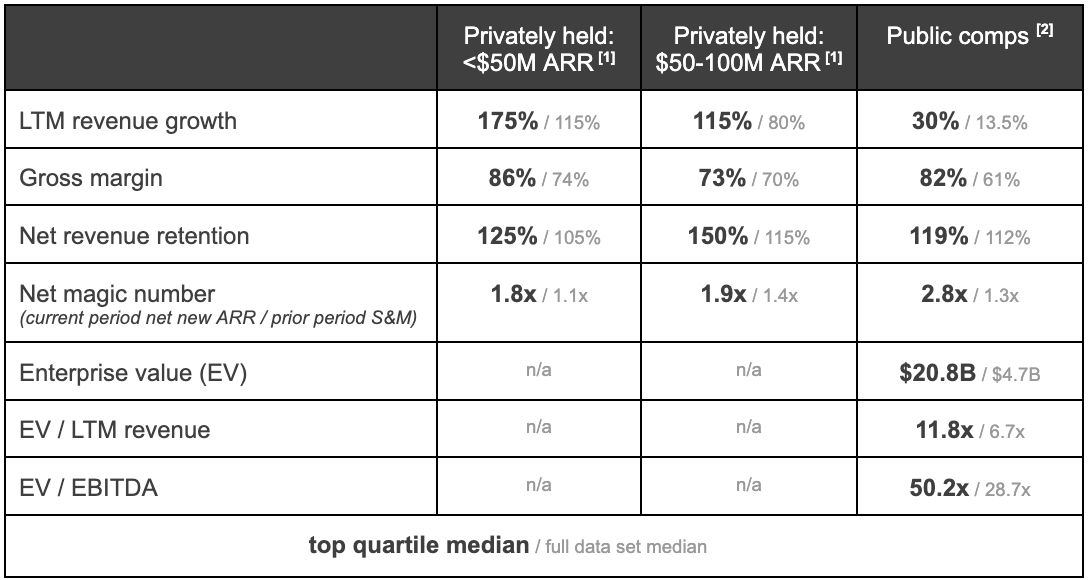

Industry specialization—the hallmark of vSaaS—drives product stickiness and capital efficiency, as illustrated by the following benchmarks:

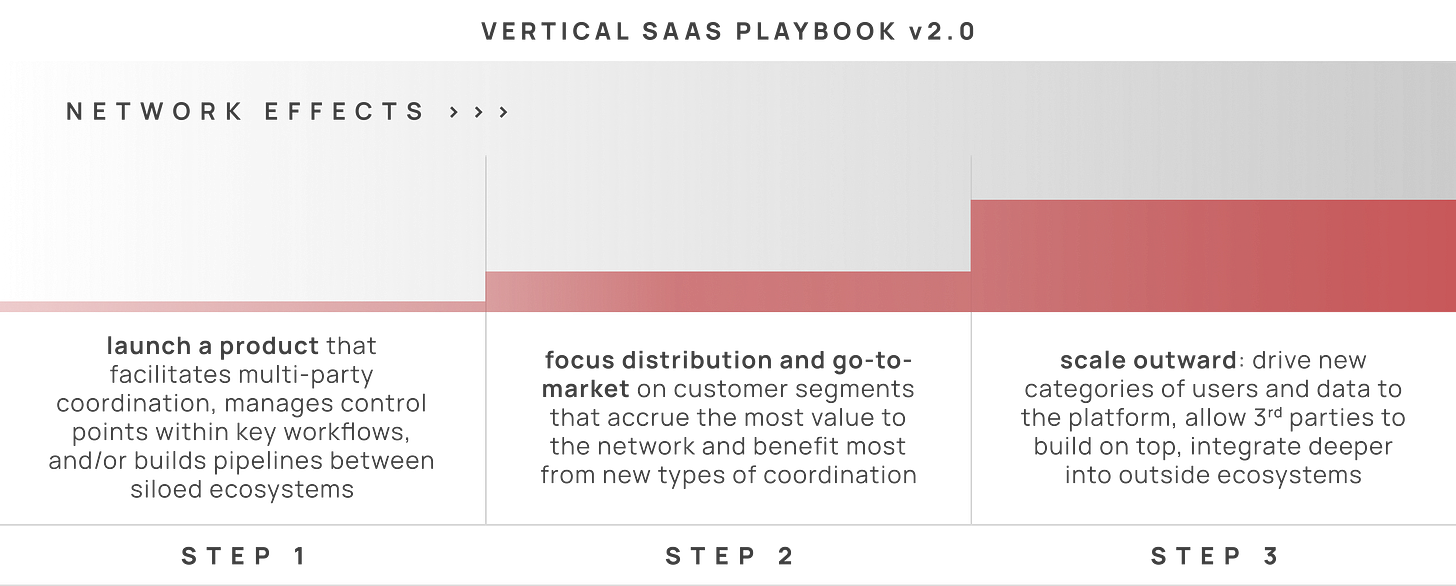

vSaaS companies typically grow by first achieving product-market fit with workflow software or point solutions, and over time layering on new products that enhance coordination between users and data assets.

As a result, network effects – where a product gains value as more users and data are added – can take years to fully develop.

Toast (NYSE: TOST) is an example of this playbook in action.

Two years after launch (2013), Toast solidified its core software product––restaurant workflow and operations software––with its point-of-sale and kitchen display system, which automated order processing and routing for a given restaurant location. By 2015, the company had scaled that product to ~1k restaurants and achieved $3M in LTM recurring revenue.[3]

Over time, Toast layered on new products, such as multi-location management (2015), APIs for third-party integrations (2016), inventory management (2016), labor reporting (2017), payroll (2019), and marketing tools (2019).[4]

These features catalyzed network effects by bringing new types of users, data assets, and interactions into the Toast ecosystem.

From Toast's 2021 S-1:[5]

“This tightly integrated platform has positive network effects for our customers… Higher spend from happier guests is correlated with higher wages for employees, which in tandem with the wage and benefits access enabled by our products, drives happier employees, lower turnover, improved quality of service, and enhanced operational efficiency.”

As network effects took hold, growth and account value compounded. Toast’s recurring revenue grew at +111% CAGR, and recurring ACV +11% CAGR, from 2015 to 2023.[6] [7] [8]

This is the old vSaaS playbook in action – start with a point-solution or workflow software for a tailored market segment, and over time expand into a multi-product platform to disrupt an industry.

02 | The drivers transforming vertical SaaS

There's a direct line between this vSaaS playbook and the technology standards of the last decade.

Centralized data storage, proprietary APIs, and SSO / in-app identity management help generate closed-loop ecosystems by allowing companies to maintain strict control over user flows and data assets. Building with these technologies requires extensive product roadmaps and custom development to achieve data liquidity, feature synchronization, and third-party integrations, all of which are essential for orchestrating network activity.

However, in the next tech cycle, I believe newer, more open technology standards will shorten the timeline for creating network effects in vSaaS products.The following are driving this transition:

Declining barriers in product development – the rise of AI and automated low/no-code tooling simplifies third-party integrations and expands the pool of network contributors to non-technical users.

Increasing standardization – standard frameworks (i.e., React/Next for front-end development, Rust for ML workflows)[9] make cross-network integrations easier, reducing the need for custom builds.

Decentralized compute – blockchain architecture is scaling, providing clear incentives for companies to transition data transactions onto these protocols. This will enhance interoperability, allowing seamless movement of users and data across applications leveraging the same Layer 1 protocol.[10]

Deeper personalization – highly customized digital experiences, powered by on-device data processing and secure LLM prompting, can dramatically reduce onboarding time, increase transaction velocity, and improve collaboration on even more complex projects.

Existing digital rails – users are already engaged on existing tech platforms (unlike the last cycle where users were transitioning to software from pen-and-paper). New vSaaS companies can leverage these existing digital workflows to accelerate user growth and adoption.

Growing externalities – heightened social awareness and rising negative externalities – particularly in sectors like energy, healthcare, and logistics – will create economic incentives for new types of cooperation and value exchange among stakeholders.

These shifts are especially well-positioned to take hold in specialized verticals, where industry-specific data needs and fine-tuned workflows create sticky use cases for these emerging technologies.

03 | The new vertical SaaS playbook

As these dynamics take hold, the vSaaS playbook will inevitably shift. Instead of building point-solutions that can grow into platforms over time, entrepreneurs will build products that power robust network effects from day one.

This playbook is especially relevant to industries with (i) high fragmentation, (ii) significant negative externalities, (iii) persistent barriers like information asymmetry and prohibitive pricing, and (iv) where outdated technology still handles essential workflows (e.g., payments, read / write pathways, or mission-critical tasks).

It’s impossible to predict exactly where the next, power law-defining vertical SaaS companies will come from and what the precise form factor will look like. But there are some spaces I’m exploring and excited about.

New networks might emerge in industries like construction and logistics, where better, more flexible software and customization can improve coordination and bring new user archetypes into the market who currently sit on the periphery (e.g., regulators, auditors, project financiers).

In pockets of healthcare, particularly where value (outcomes per unit cost) lags behind peer OECD countries, new networks can solve problems that require buy-in from multiple stakeholders—patients, payers, providers, suppliers, and pharma. For example, Alma is driving new network activity between providers, patients, and payers to reduce cost and access barriers in mental health.

The growing costs and externalities of climate change in sectors like energy and agriculture can incentivize the adoption of decentralized protocols for transparent data tracking, multi-party coordination, and risk monitoring. Epoch is driving this type of data architecture in supply chains for large multinationals.

In high-security industries such as legal and finance, leveraging AI for automated threat detection or new encryption techniques for data masking can break down long-standing data silos.

More intimate, verticalized social networks can build lucrative, high-transaction ecosystems on top of larger networks with portable identity management (e.g., Farcaster). The alienation and misinformation users experience on existing platforms can drive adoption of these new networks.

These are just a few examples.

As we look to the future, the convergence of open technology standards and evolving market dynamics presents a massive opportunity for entrepreneurs in specialized markets.

Startups that capitalize on these shifts – and build products capable of facilitating new network dynamics from the outset – will be well-positioned to drive outsized value creation in this next cycle.

Endnotes:

[1] Source. Data aggregated across 22 private vertical SaaS companies as of Aug 2023.

[2] Source, source. Market data as of June 7, 2024. Data from 28 public companies: 2U (TWOU), Alkami Technologies (ALKT), Appfolio (APPF), Aspen Technology (AZPN), Autodesk (ADSK), Bentley Systems (BSY), Blackbaud (BLKB), Blend (BLND), CS Disco (LAW), Doximity (DOCS), EverCommerce (EVCM), Guidewire (GWRE), Instructure (INST), Intapp (INTA), LegalZoom (LZ), Lightspeed Commerce (LSPD), nCino (NCNO), Olo (OLO), PowerSchool (PWSC), Procore (PCOR), Q2 (QTWO), Sabre (SABR), Samsara (IOT), Shopify (SHOP), SmartRent (SMRT), Toast (TOST), Tyler Technologies (TYL), Veeva Systems (VEEV)

[3] Source. Recurring revenue defined as annual software subscription revenue + annual payments gross margin. This excludes revenue related to hardware and professional services.

[4] Source. See page 6 for products released by year.

[5] Source. See page 139 for more details on Toast’s network effects.

[6] Recurring revenue = LTM subscription revenue + LTM fintech gross profit

[7] Source. See page 22 for 2019 financials and page 6 for 2019 total locations.

[8] Source. See page 78 for 2023 financials and page 70 for 2023 total locations.

[9] React is preferred by 42% of professional developers and Next.js has quickly moved from 11th place to 6th place in terms of preferred architectures. Source.

[10] Layer 1 protocol refers to the base layer of a blockchain network, responsible for the fundamental operations upon which additional applications can be built and the underlying consensus mechanism that validates and secures transactions. Examples of Layer 1 protocols include Bitcoin, Ethereum, and Solana.